As consumers socialize more this year, retailers around the world are competing for sales in the torrid health & beauty category.

That’s why we at DataWeave wanted to know how Prime Day 2021 discounts played a role in the pricing strategies for health & beauty products. We focused our analysis on how global retailers adapted their Prime Day pricing strategies to distinguish their offerings across seven health & beauty subcategories, including makeup, health care and baby care.

Our Methodology

We tracked the pricing of products among 16 leading retailers in nine countries across five regions, including:

● The US (Amazon US, Sephora, Target, Ulta and Walmart)

● The UK (Amazon UK, Ebay, Etsy and OnBuy)

● Europe (Amazon France, Amazon Germany and Amazon Italy)

● The Middle East (Amazon Saudi Arabia and Amazon UAE)

● Asia (Amazon Japan and Amazon Singapore)

The results showed some surprising differences among retailers and regions. See how retailers used pricing as a competitive strategy to win Prime Day sales in the health & beauty category, as well as international health & beauty brands that stood out for the discounts on their products.

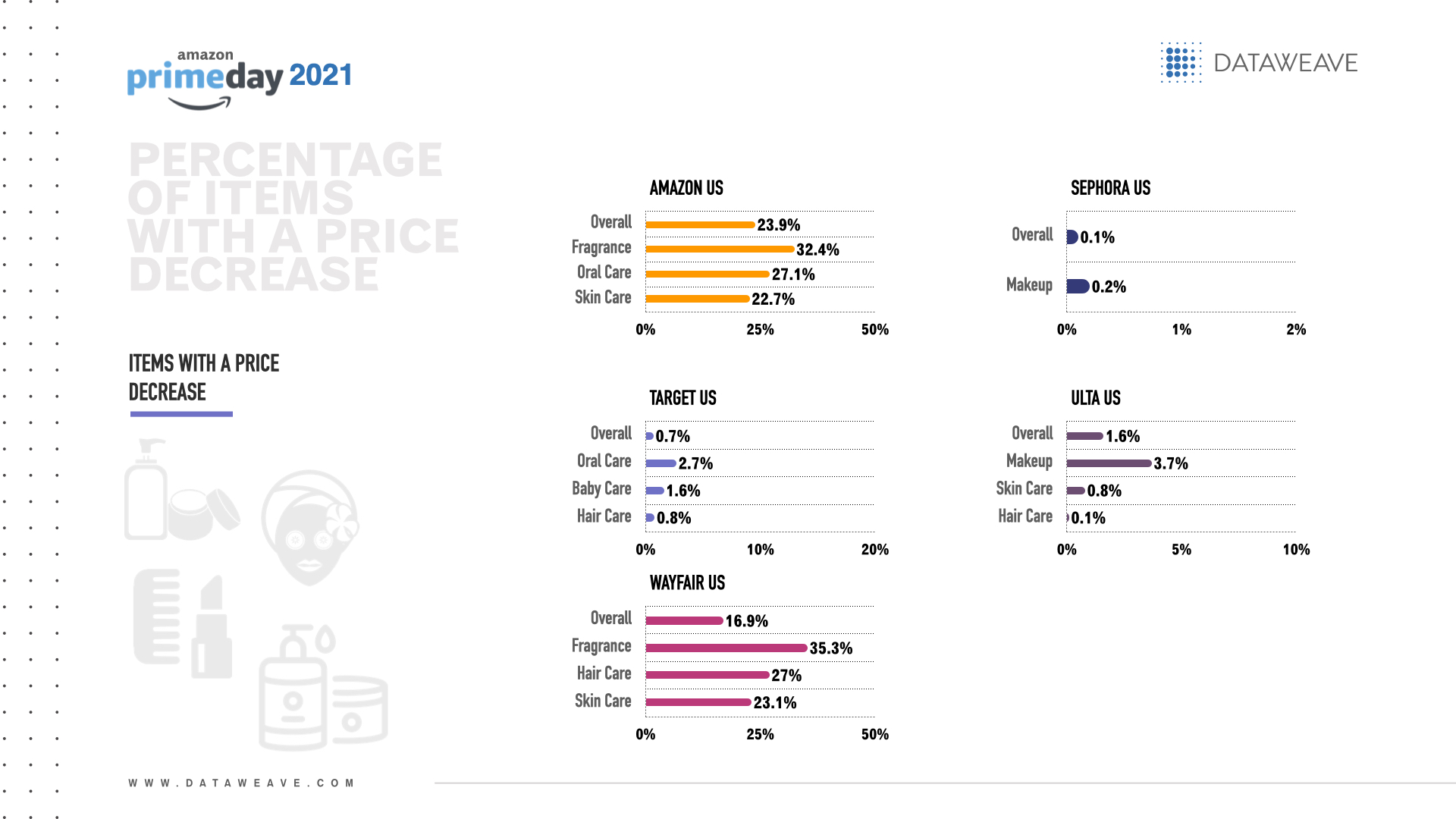

Percentage of items with a price decrease

The US retailer with the overall highest percentage of health & beauty products with a price decrease for Prime Day was Amazon US (23.9%).

Health & beauty subcategories with the highest percentage of items with a price decrease per US retailer were:

● Amazon US: Fragrance (32.4%), oral care (27.1%) and skin care (22.7%)

● Sephora: Makeup (0.2%)

● Target: Oral care (2.7%), baby care (1.6%) and hair care (0.8%)

● Ulta: Makeup (3.7%), skin care (0.8%) and hair care (0.1%)

● Walmart: Fragrance (35.3%), hair care (27.0%) and skin care (23.1%)

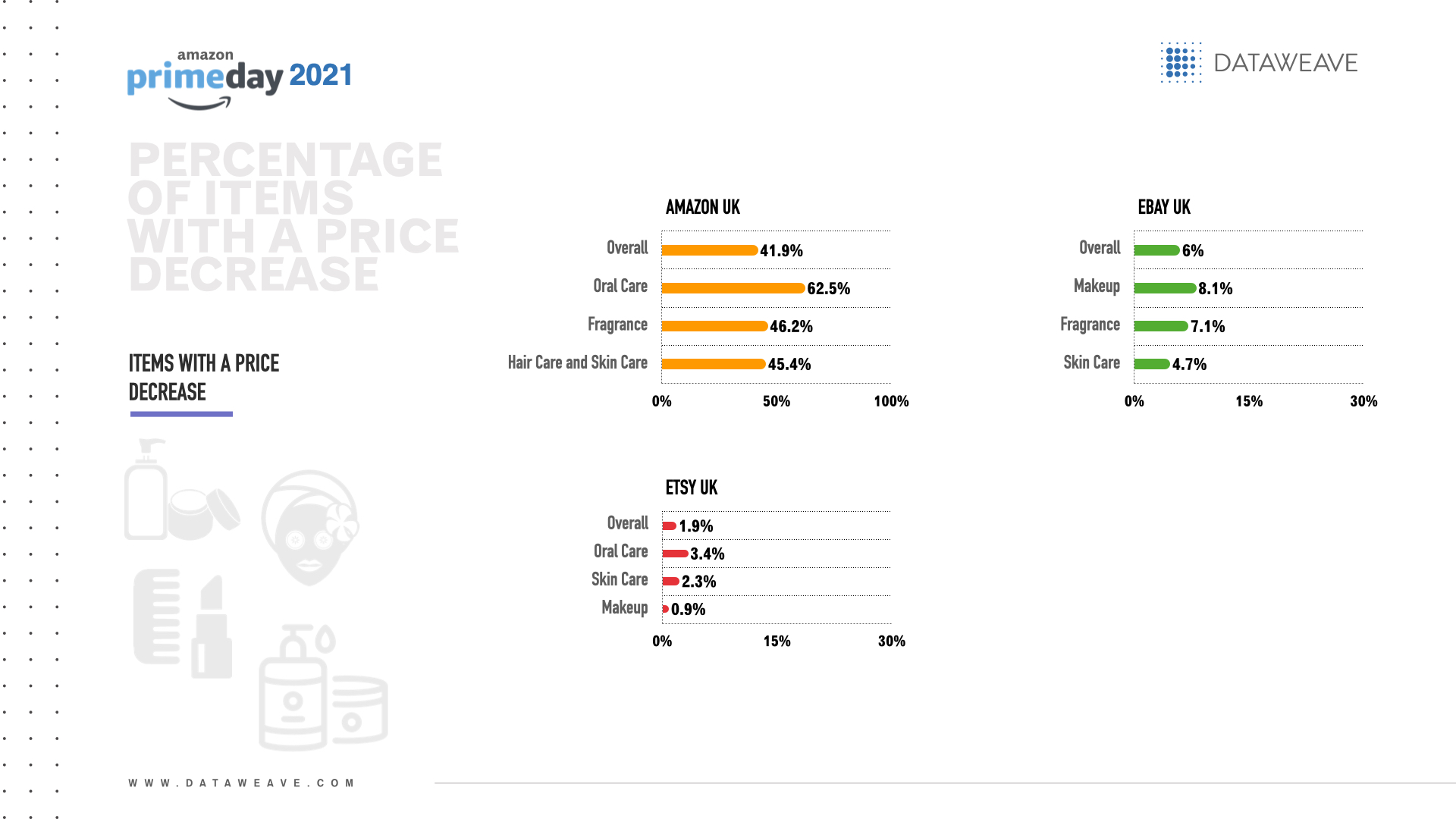

By far, the UK retailer with the overall highest percentage of items with a price decrease for Prime Day was Amazon UK (41.9%).

Health & beauty subcategories with the highest percentage of items with a price decrease per UK retailer were:

● Amazon UK: Oral care (62.5%), fragrance (46.2%) and hair care and skin care (both 45.4%)

● Ebay: Makeup (8.1%), fragrance (7.1%) and skin care (4.7%)

● Etsy: Oral care (3.4%), skin care (2.3%) and makeup (0.9%)

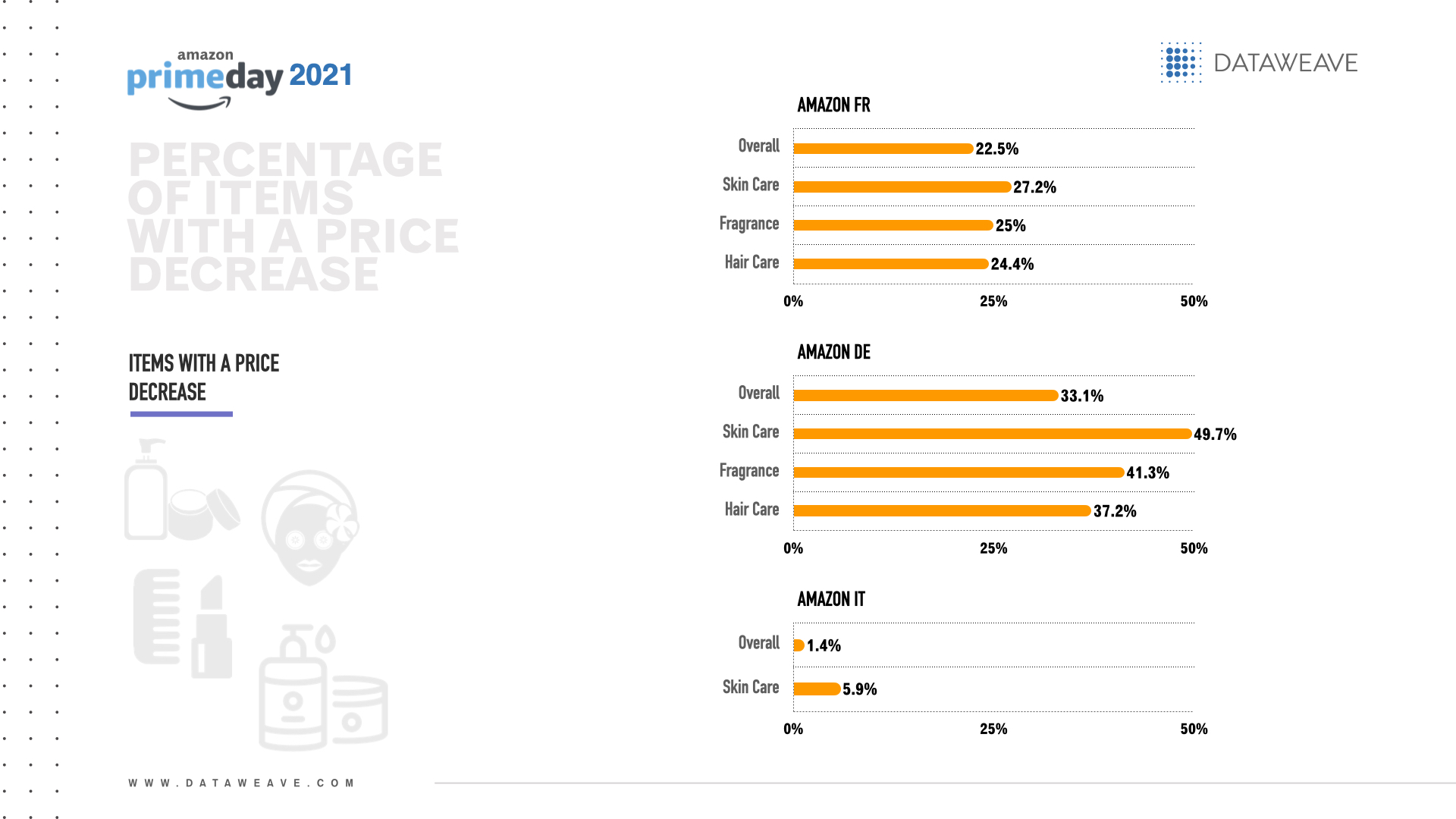

In Europe, Amazon Germany had the overall highest percentage of items with a price decrease for Prime Day (33.1%).

Health & beauty subcategories with the highest percentage of items with a price decrease per European retailer were:

● Amazon France: Skin care (27.2%), fragrance (25.0%) and hair care (24.4%)

● Amazon Germany: Skin care (49.7%), fragrance (41.3%) and hair care (37.2%)

● Amazon Italy: Skin care (5.9%)

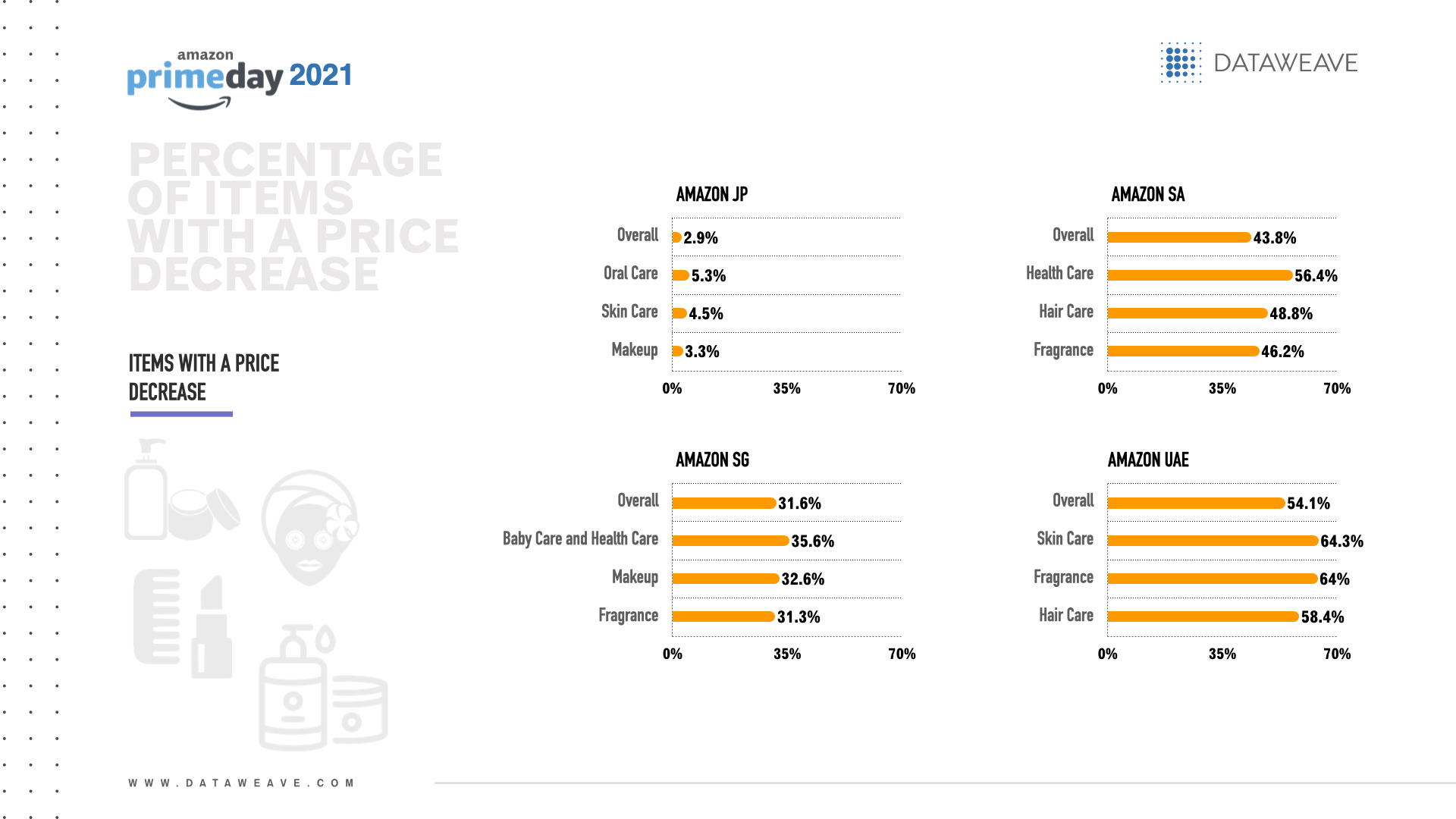

Across the Middle East & Asia, Amazon UAE had the overall highest percentage of health & beauty items with a price decrease for Prime Day (54.1%).

Health & beauty subcategories with the highest percentage of items with a price decrease per retailer were:

● Amazon Saudi Arabia: Health care (56.4%), hair care (48.8%) and fragrance (46.2%)

● Amazon UAE: Skin care (64.3%), fragrance (64.0%), and hair care (58.4%)

● Amazon Japan: Oral care (5.3%), skin care (4.5%) and makeup (3.3%)

● Amazon Singapore: Baby care and health care (both 35.6%), makeup (32.6%) and fragrance (31.3%)

Magnitude of price decrease

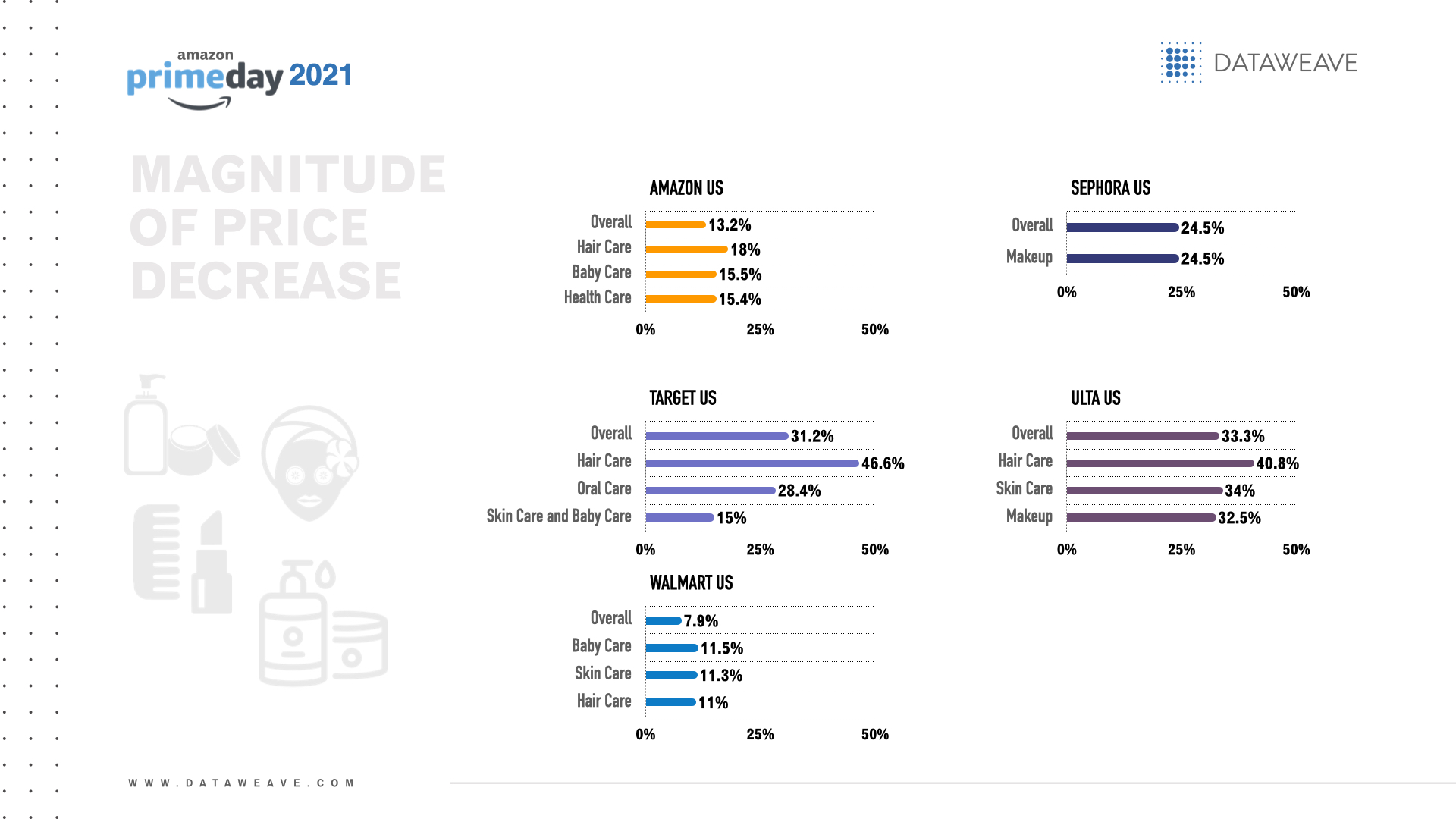

The US retailer with the greatest overall magnitude of price decrease for Prime Day was Ulta (33.3%).

The health & beauty subcategories with the greatest magnitude of price decrease per US retailer were:

● Amazon US: Hair care (18.0%), baby care (15.5%) and health care (15.4%)

● Sephora: Makeup (24.5%)

● Target: Hair care (46.6%), oral care (28.4%) and skin care and baby care (both 15.0%)

● Ulta: Hair care (40.8%), skin care (34.0%) and makeup (32.5%)

● Walmart: Baby care (11.5%), skin care (11.3%) and hair care (11.0%)

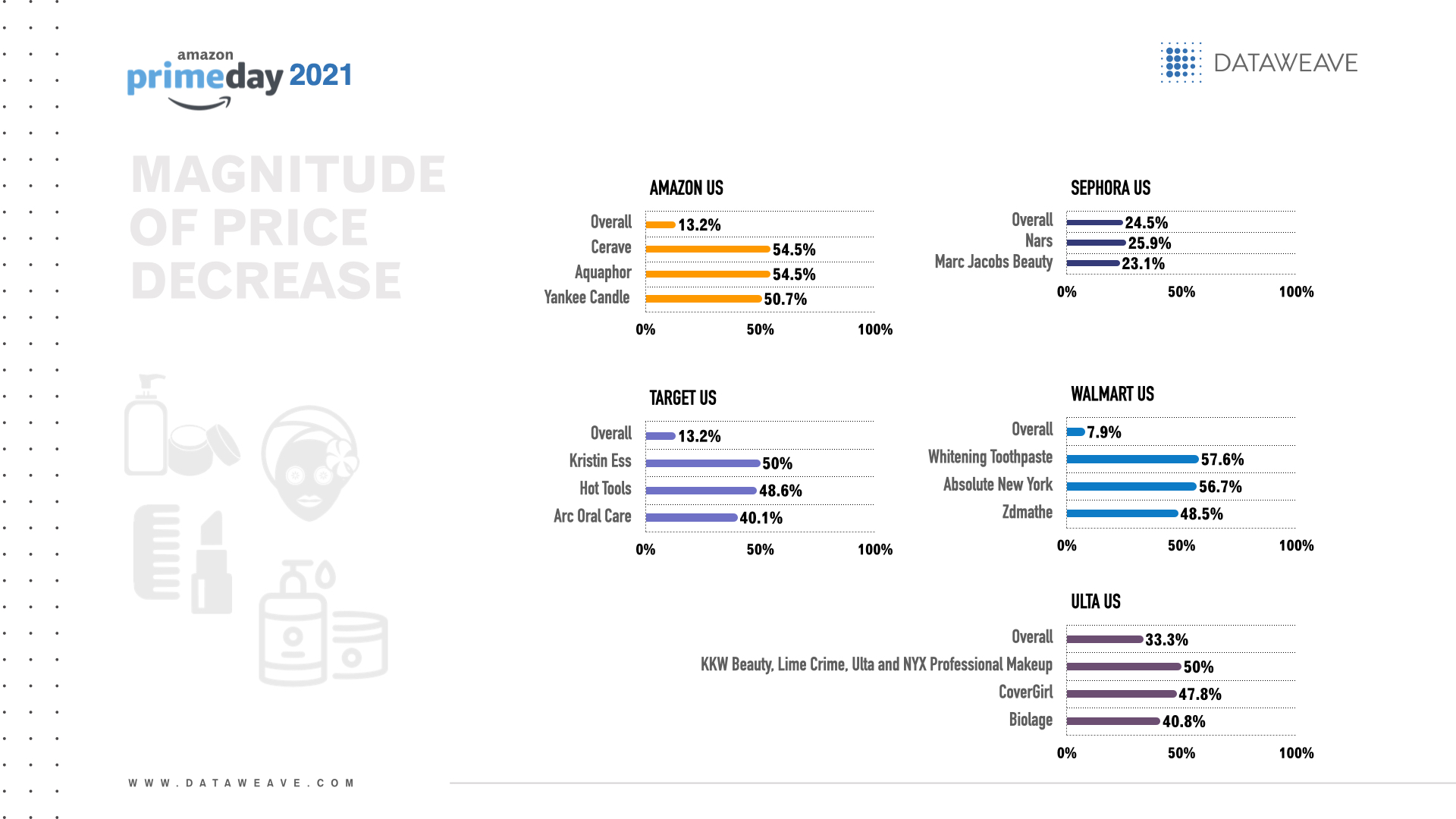

Brands with the greatest magnitude of price decreases per US retailer included:

● Amazon US: Cerave (54.5%), Aquaphor (54.4%) and Yankee Candle (50.7%)

● Sephora: Nars (25.9%) and Marc Jacobs Beauty (23.1%)

● Target: Kristin Ess (50.0%), Hot Tools (48.6%) and Arc Oral Care (both 40.1%)

● Ulta: KKW Beauty, Lime Crime, Ulta and NYX Professional Makeup (all 50.0%), CoverGirl (47.8%) and Biolage (40.8%)

● Walmart: Whitening Toothpaste (57.6%), Absolute New York (56.7%) and Zdmathe (48.5%)

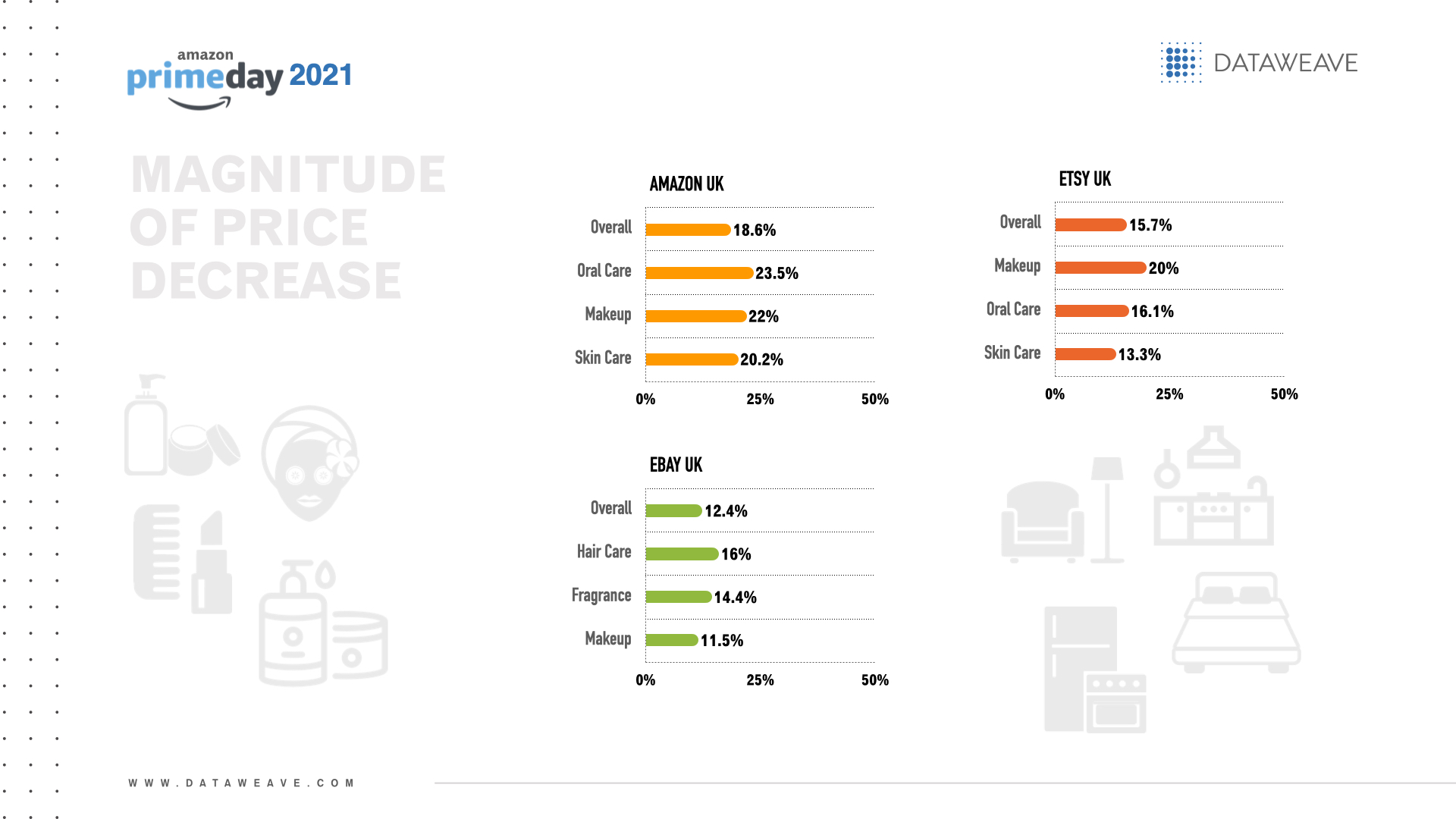

The UK retailer with the greatest overall magnitude of price decrease on health & beauty products for Prime Day was Amazon UK (18.6%).

The health & beauty subcategories with the greatest magnitude of price decrease per UK retailer were:

● Amazon UK: Oral care (23.5%), makeup (22.0%) and skin care (20.2%)

● Ebay: Hair care (16.0%), fragrance (14.4%) and makeup (11.5%)

● Etsy: Makeup (20.0%), oral care (16.1%) and skin care (13.3%)

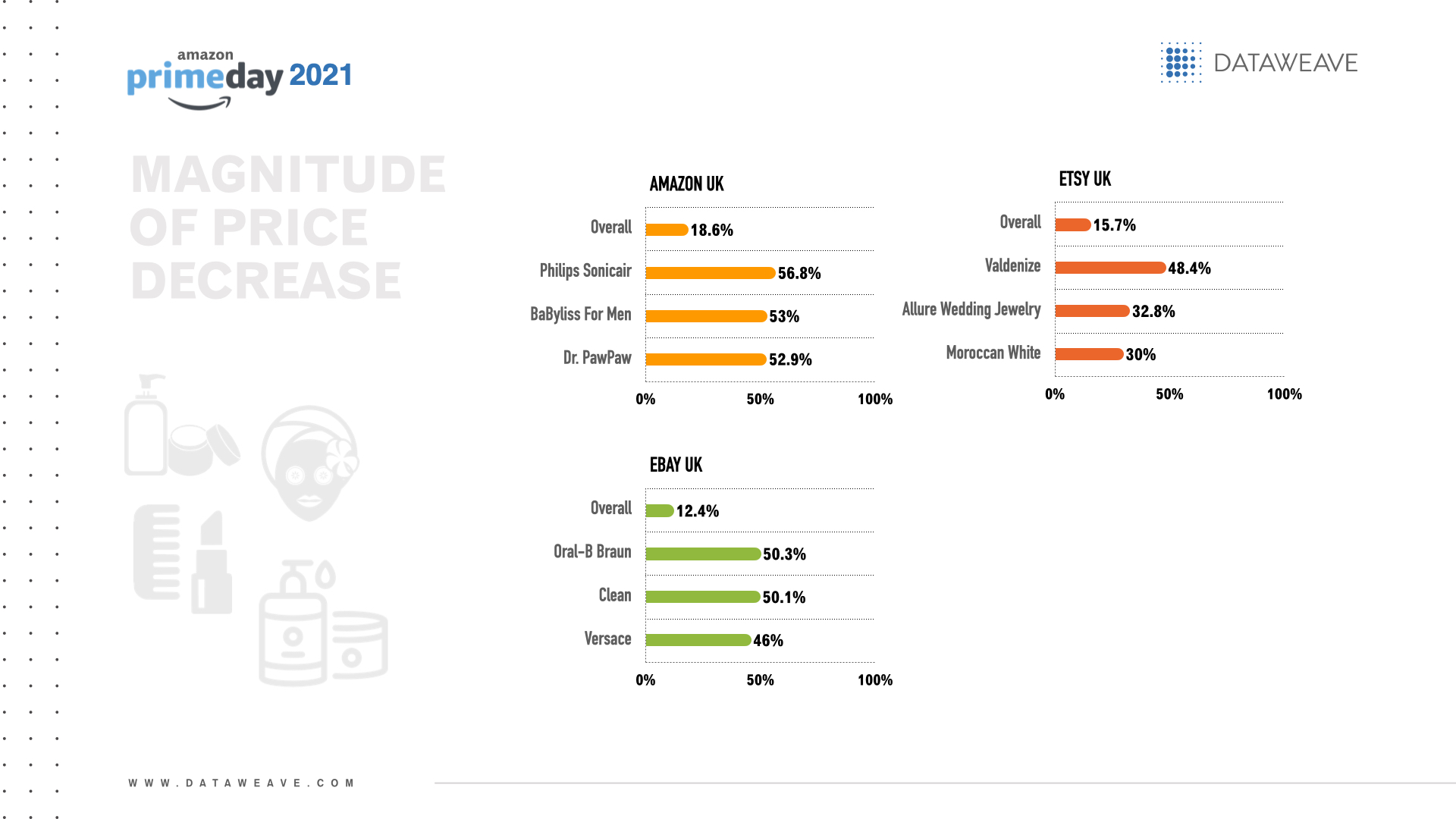

Brands with the greatest magnitude of price decreases across health & beauty sub-categories per UK retailer included:

● Amazon UK: Philips Sonicair (56.8%), BaByliss For Men (53.0%) and Dr. PawPaw (52.9%)

● Ebay: Oral-B Braun (50.3%), Clean (50.1%) and Versace (46.0%)

● Etsy: Valdenize (both 48.4%), Allure Wedding Jewelry (32.8%) and Moroccan White (30.0%)

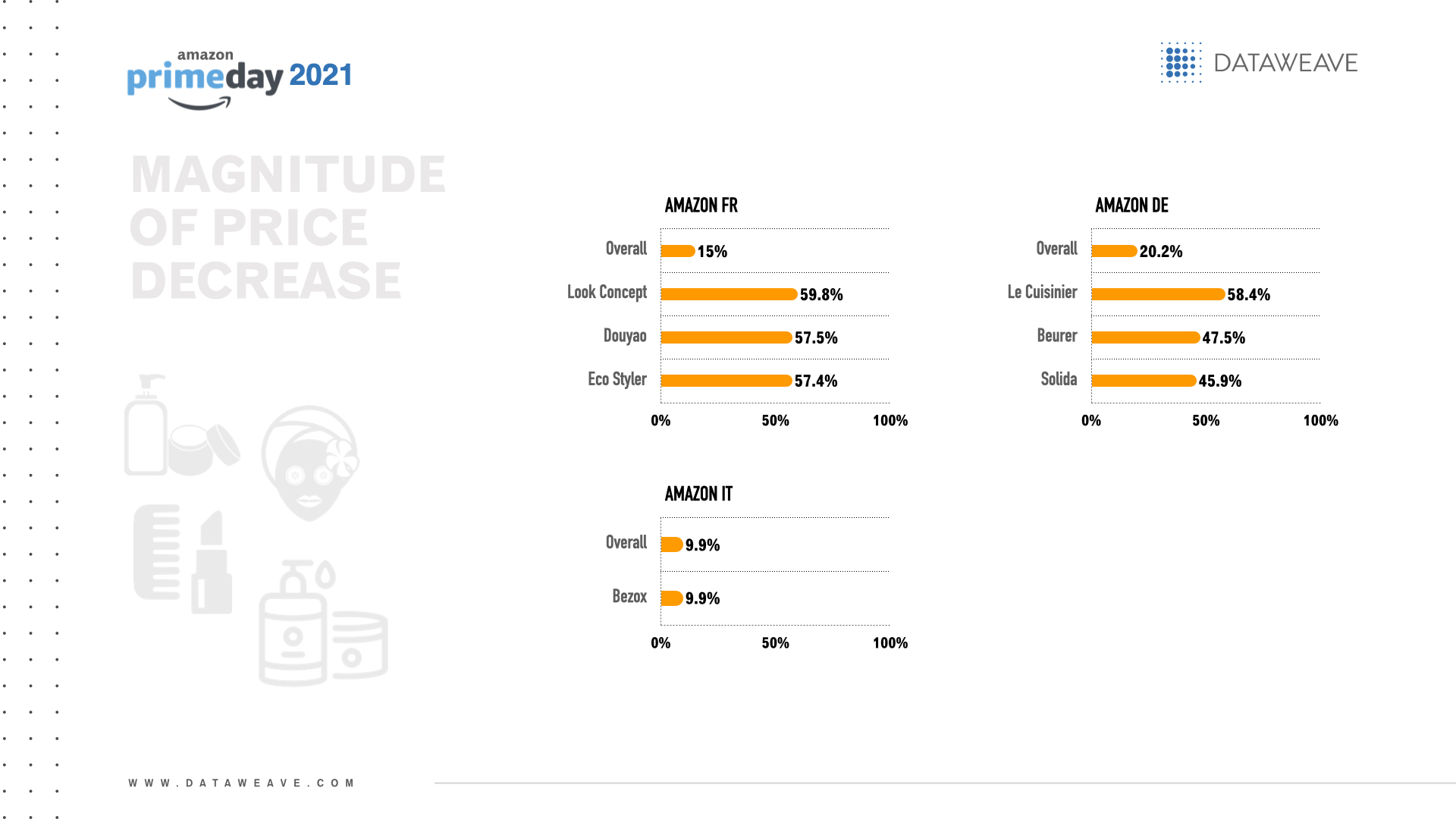

Among European retailers, Amazon Germany offered the greatest overall magnitude of price decrease on health & beauty products for Prime Day (20.2%).

The health & beauty subcategories with the greatest magnitude of price decrease per European retailer were:

● Amazon France: Skin care (20.4%), baby care (17.8%) and makeup (16.2%)

● Amazon Germany: Skin care (28.2%), makeup (22.6%) and health care (21.3%)

● Amazon Italy: Skin care (9.9%)

Brands with the greatest magnitude of price decreases per European retailer included:

● Amazon France: Look Concept (59.8%), Douyao (57.5%) and Eco Styler (57.4% for both hair care and health care)

● Amazon Germany: Le Cuisinier (58.4%), Beurer (47.5%) and Solida (45.9%)

● Amazon Italy: Bezox (9.9%)

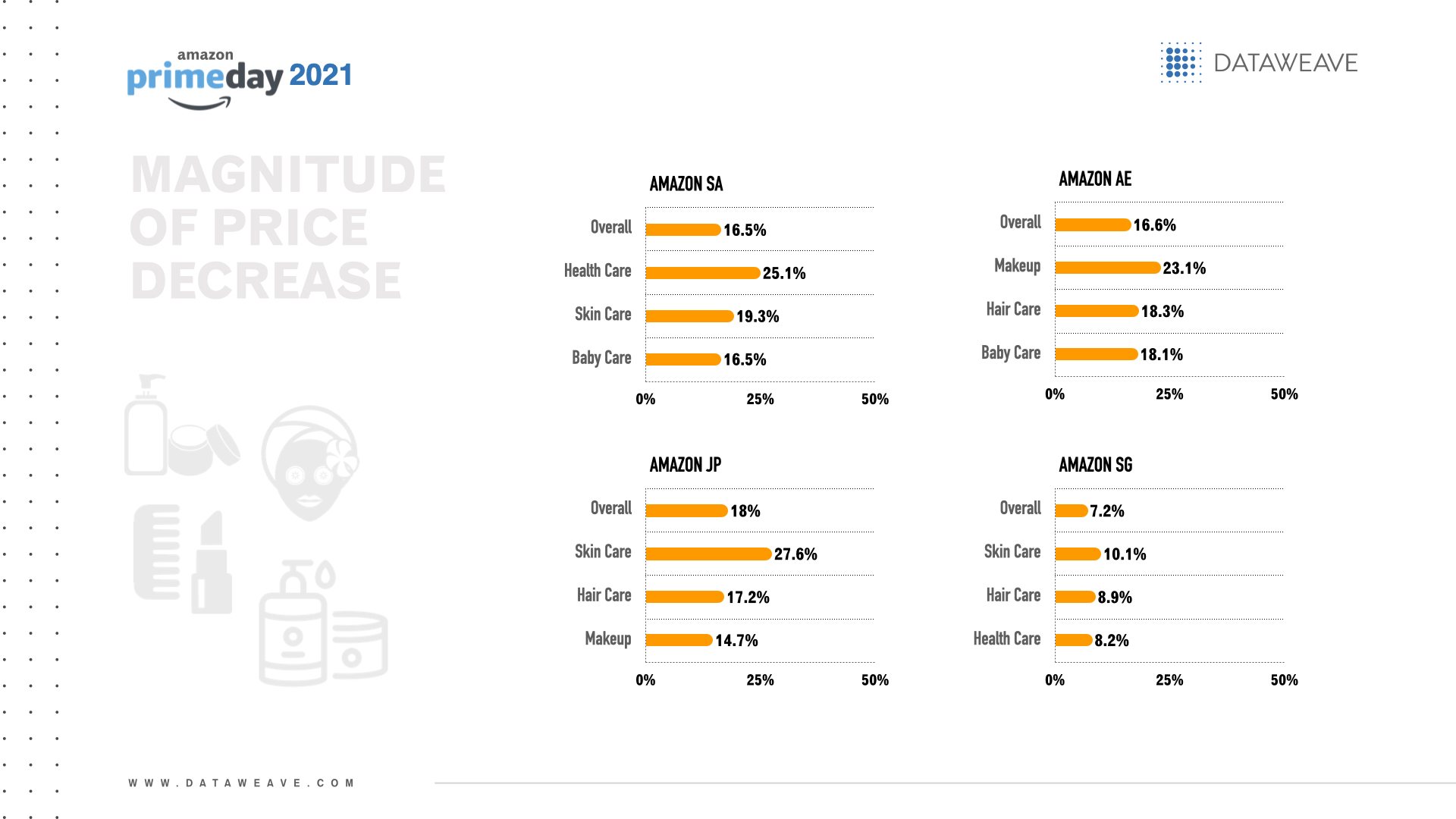

Across the Middle East and Asia, Amazon Japan offered the greatest overall magnitude of price decrease on health & beauty products for Prime Day (18.0%).

The health & beauty subcategories with the greatest magnitude of price decrease per retailer were:

● Amazon Saudi Arabia: Health care (25.1%), skin care (19.3%) and baby care (16.5%)

● Amazon UAE: Makeup (23.1%), hair care (18.3%) and baby care (18.1%)

● Amazon Japan: Skin care (27.6%), hair care (17.2%) and makeup (14.7%)

● Amazon Singapore: Skin care (10.1%), hair care (8.9%) and health care (8.2%)

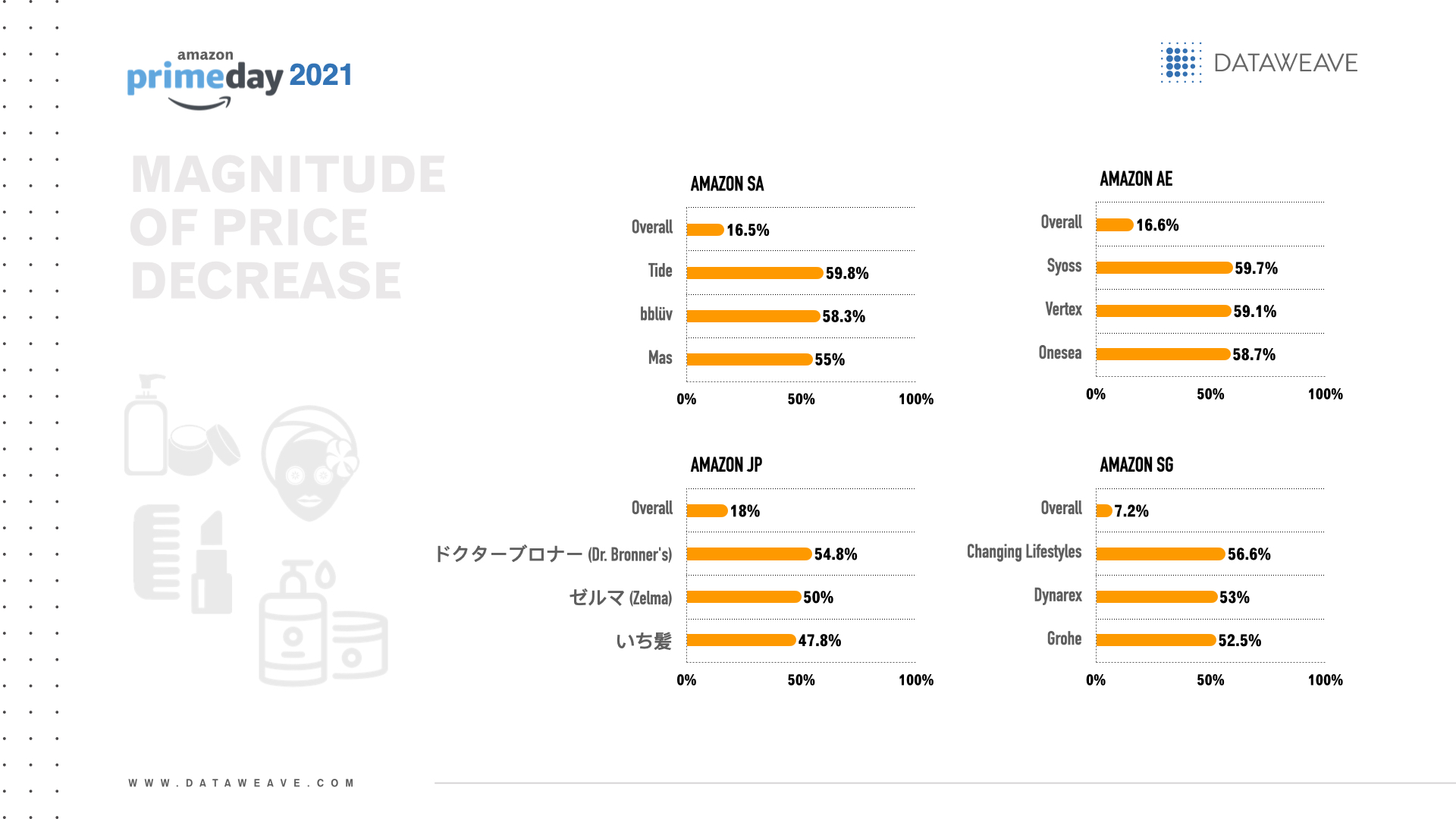

Brands with the greatest magnitude of price decreases per retailer in the Middle East and Asia included:

● Amazon Saudi Arabia: Tide (59.8%), bblüv (58.3%) and Mas (55.0%)

● Amazon UAE: Syoss (59.7%), Vertex (59.1%) and Onesea (58.7%)

● Amazon Japan: ドクターブロナー (Dr. Bronner’s) (54.8%), ゼルマ (Zelma) (50.0%) and いち髪 (47.8%)

● Amazon Singapore: Changing Lifestyles (56.6%), Dynarex (53.0%) and Grohe (52.5%)

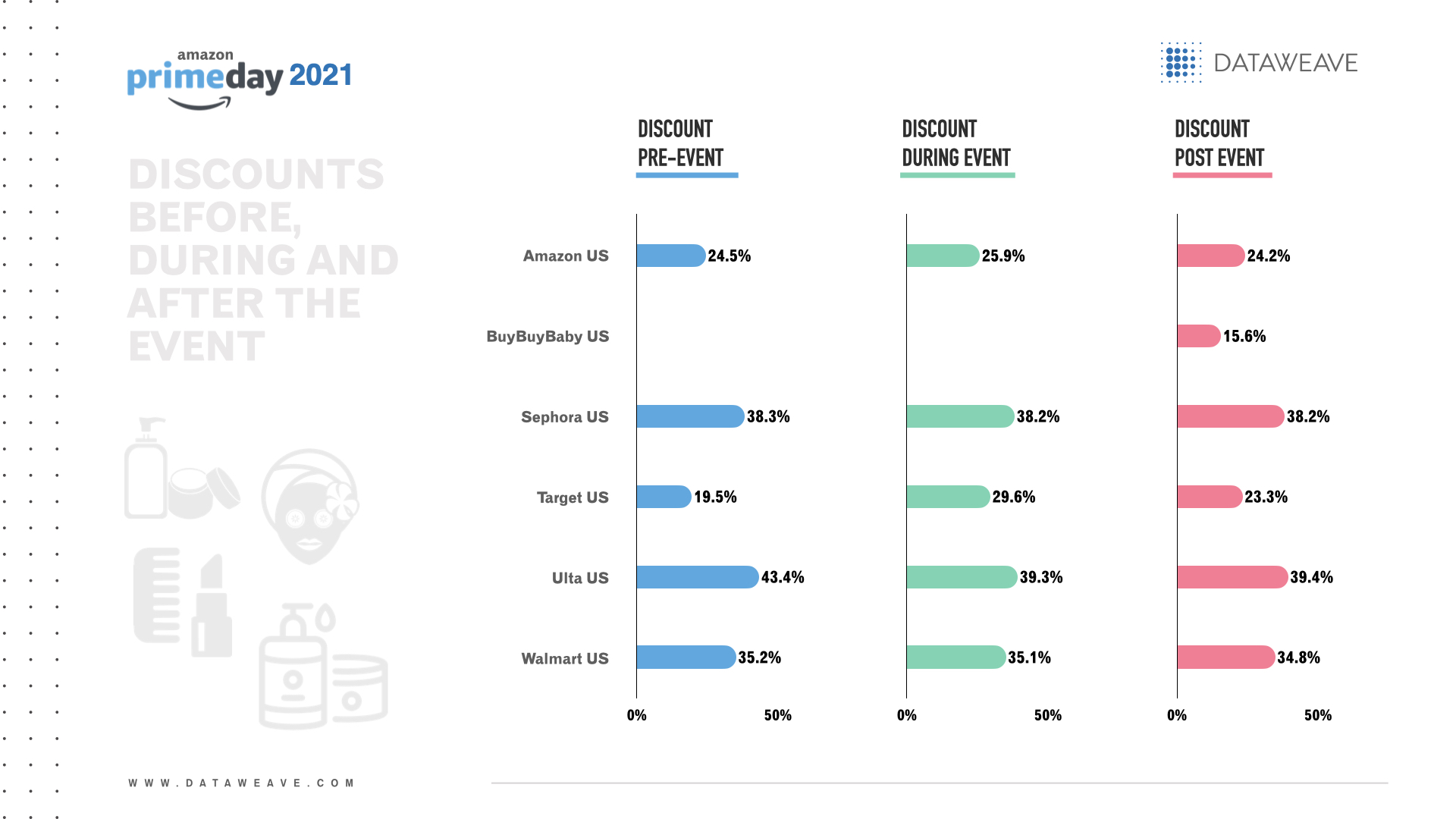

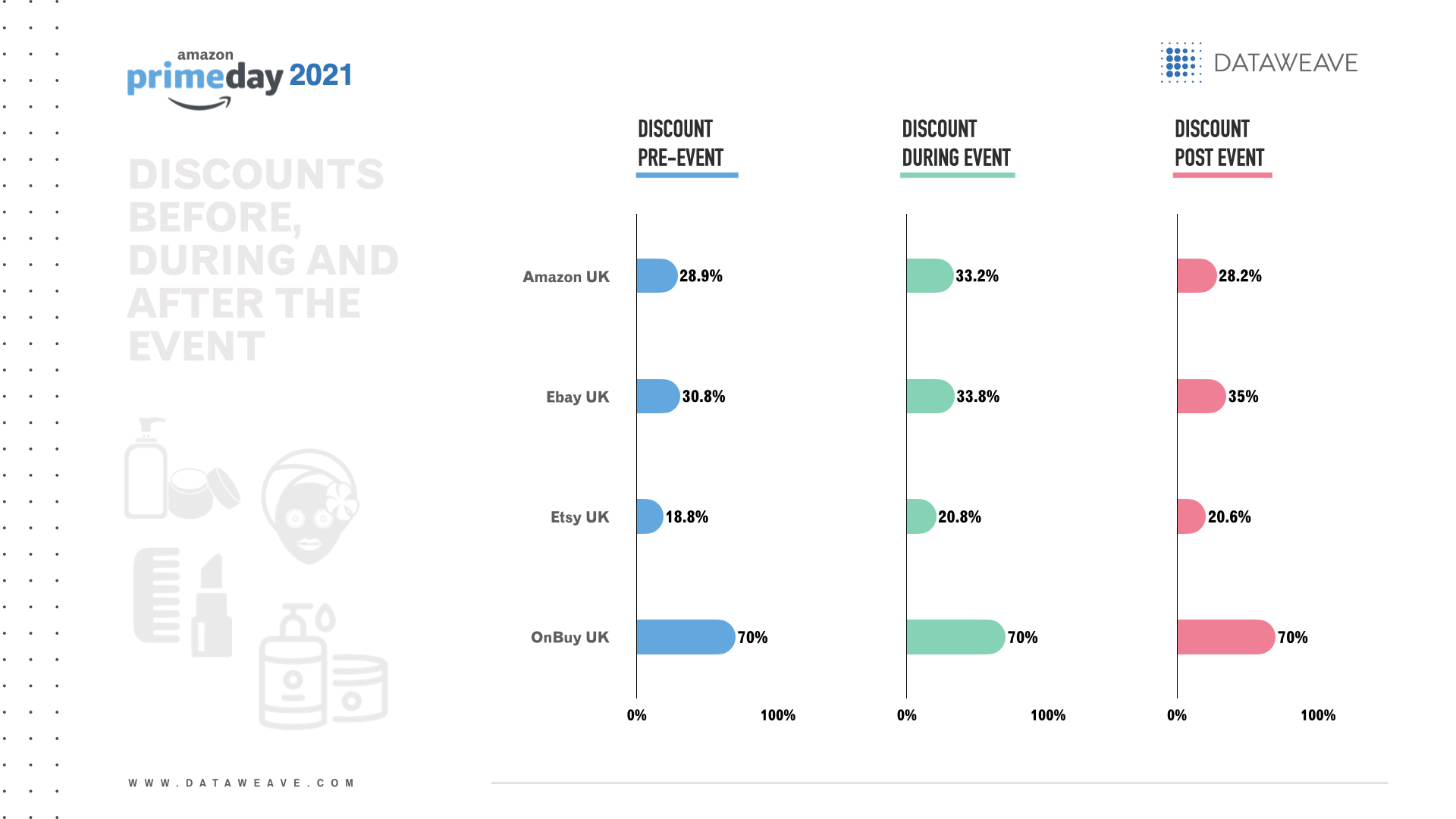

Discounts before, during and after the event

In the US, specialty beauty retailers’ discounts stood out during Prime Day sales. The US retailer with the biggest overall health & beauty discount before (43.4%), during (39.3%) and after (39.4%) Prime Day was Ulta. During and after Prime Day, Sephora was a close second at 38.2% for both periods.

Ulta’s biggest pre-event discounts were on makeup (44.2%) and skin care (33.0%). Hair care (40.8%). makeup (39.5%) and skin care (36.0%) were the leading subcategories for Ulta’s discounts during Prime Day. After the event, Ulta’s biggest discounts were for hair care (40.8%), makeup (39.6%) and skin care (37.3%)

In the UK, OnBuy offered the highest discounts before, during and after Prime Day at 70.0% off baby care products. Yet the total product count was only 2.

Among the remaining rivals, all of whom had a product count above 1000, Ebay had the highest discounts before (30.8%), during (33.8%) and after (35.0%) Prime Day.

Before Prime Day, Ebay biggest discounts were on hair care (48.9%), fragrance (23.9%) and makeup (23.4%). Ebay’s top discounts during Prime Day were on hair care (50.3%), makeup (24.9%) and fragrance (24.8%). Similarly, after the event, Ebay had the biggest discounts on hair care (49.9%), makeup (26.7%) and fragrance (26.2%).

Across retailers in the Middle East & Asia, Amazon UAE offered the biggest overall health & beauty discounts before (26.0%), during (30.7%) and after (26.0%) Prime Day.

In the pre-sales event, Amazon UAE offered the most generous discounts on makeup (30.7%), fragrance (29.9%) and health care (29.2%).

During Prime Day, Amazon UAE’s biggest discounts were on makeup (37.2%), fragrance (31.6%) and health care (31.3%).

During Prime Day, Amazon UAE offered the biggest discounts on fragrance (30.5%), makeup (30.0%) and health care and baby care (both 26.8%).

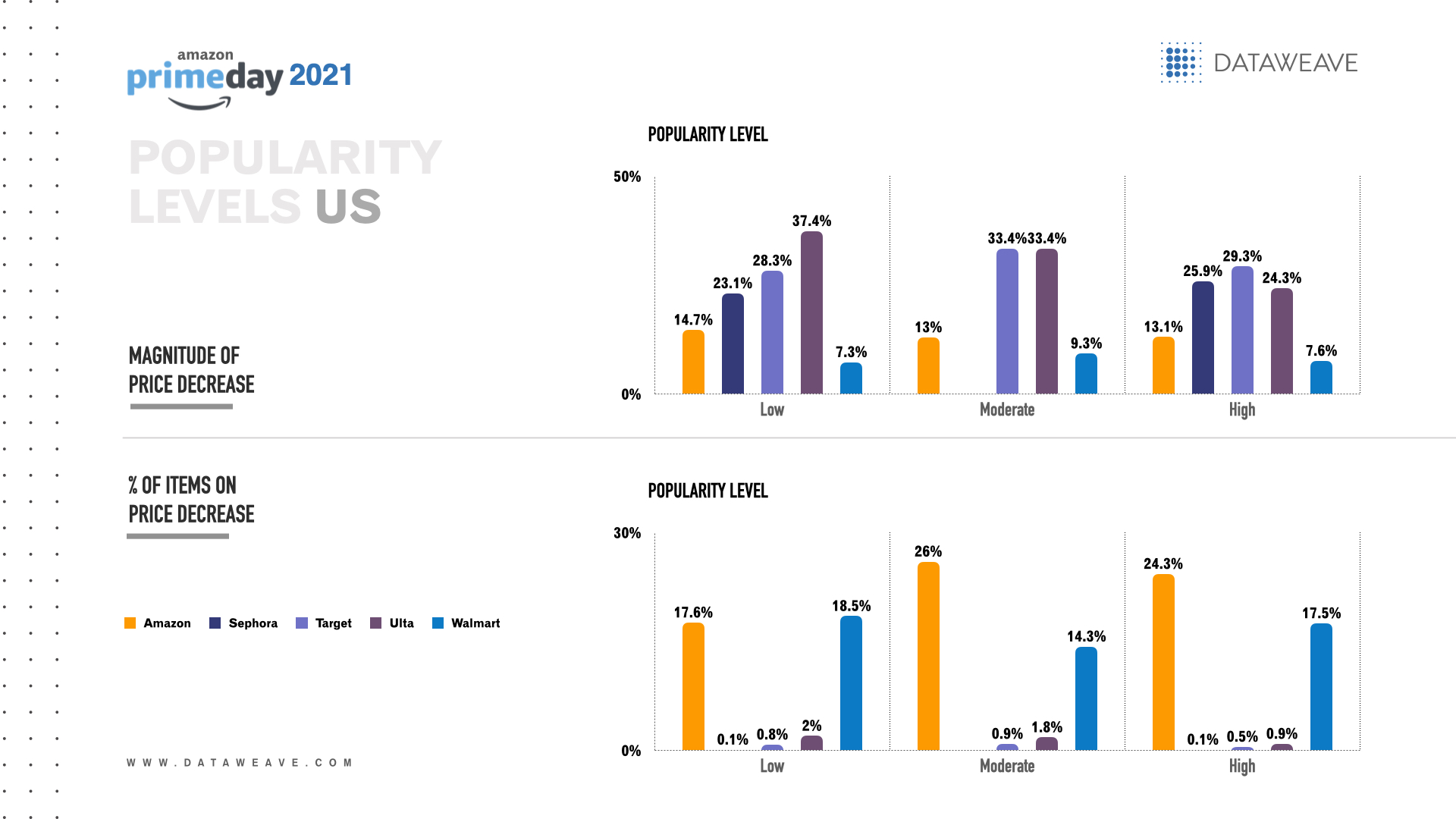

Popularity

In the US, among health & beauty products with high popularity, Amazon US offered the highest percentage of items with a price decrease (24.3%) and Target offered the greatest magnitude of price decrease (29.3%).

For health & beauty items with medium popularity, Amazon US offered the highest percentage of items with a price decrease (26.0%), and strategic partners Target and Ulta both offered the greatest magnitude of price decrease (33.4%).

Among health & beauty merchandise with low popularity, Walmart offered the highest percentage of items with a price decrease (18.5%) and Ulta offered the greatest magnitude of price decrease (37.4%).

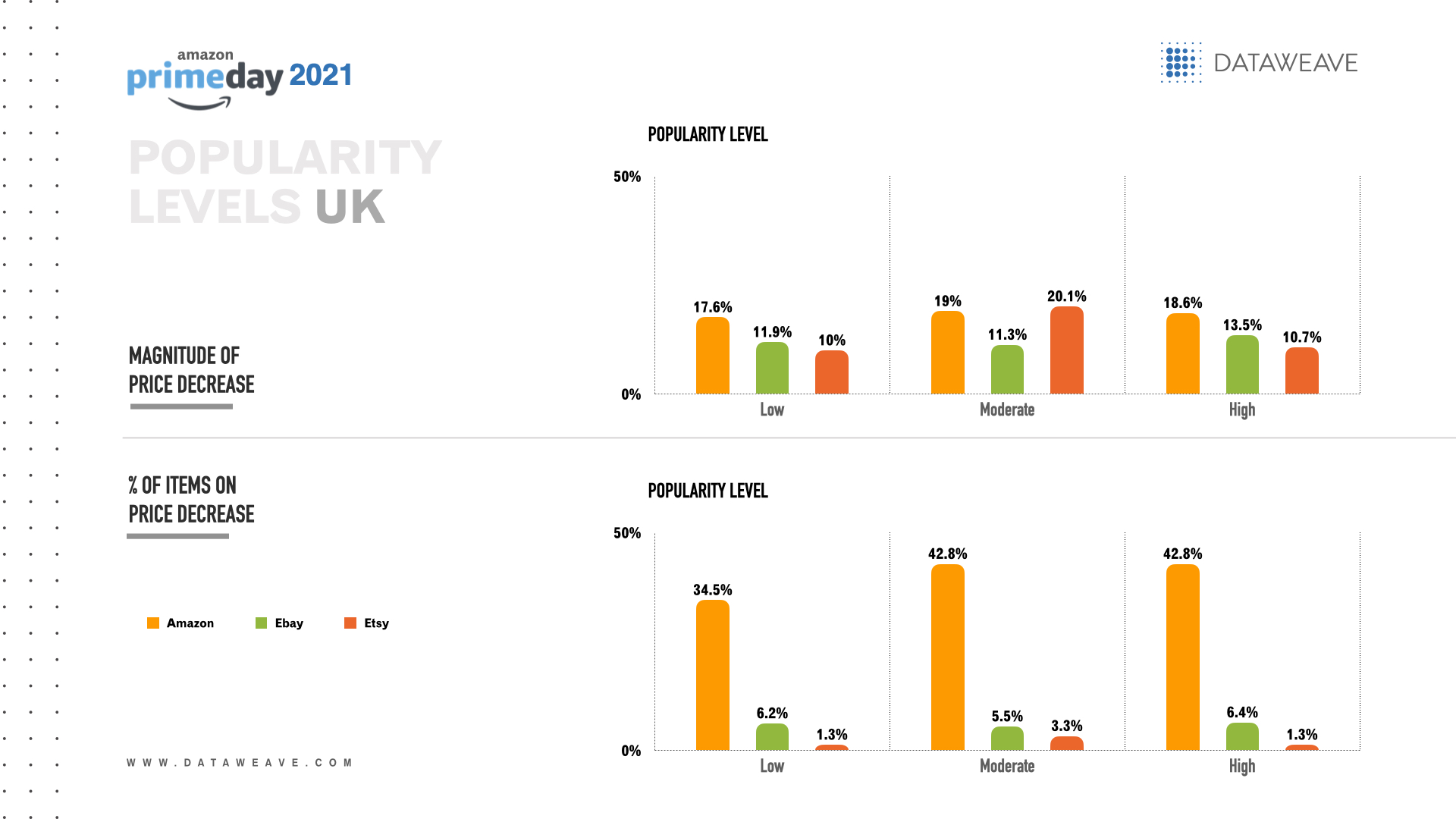

Amazon UK stood out among all levels of health & beauty product popularity.

In the UK, among health & beauty products with high popularity, Amazon UK offered both the highest percentage of items with a price decrease (42.8%) and the greatest magnitude of price decrease (18.6%).

For health & beauty items with medium popularity, Amazon UK offered the highest percentage of items with a price decrease (42.8%) and Etsy offered the greatest magnitude of price decrease (20.1%).

Among health & beauty merchandise with low popularity, Amazon UK offered both the highest percentage of items with a price decrease (35.4%) and the greatest magnitude of price decrease (17.6%).

In Europe, Amazon Germany dominated discounts for health & beauty products across all levels of popularity.

Among health & beauty goods with high popularity, Amazon Germany offered both the highest overall percentage of items with a price decrease (34.6%) and the greatest overall magnitude of price decrease (20.6%).

For health & beauty items with medium popularity, Amazon Germany offered both the highest percentage of items with a price decrease (32.7%) and the greatest magnitude of price decrease (20.0%).

Among health & beauty merchandise with low popularity, Amazon Germany offered the highest percentage of items with a price decrease (33.5%) and the greatest magnitude of price decrease (20.6%).

In Middle East & Asia, among health & beauty items with high popularity, Amazon UAE offered the highest overall percentage of items with a price decrease (53.0%) and Amazon Saudi Arabia had the greatest overall magnitude of price decrease (18.7%).

For health & beauty products with medium popularity, Amazon UAE offered the highest overall percentage of items with a price decrease (55.3%) and Amazon Saudi Arabia had the greatest overall magnitude of price decrease (19.7%).

Among health & beauty goods with low popularity, Amazon UAE offered the highest percentage of items with a price decrease (54.5%) and Amazon Japan had the greatest magnitude of price decrease (18.7%).

Health & beauty’s stunning Prime Day deals

Overall, Prime Day 2021 gave shoppers around the world the opportunity to score generous discounts on health & beauty products.

According to our analysis, the retailers whose Prime Day pricing stood out the most were Amazon US and Ulta in the US, Amazon UK and Ebay in the UK, Amazon Germany in Europe, Amazon UAE in the Middle East and Amazon Japan in Asia.

Stay tuned for Prime Day 2021 international fashion and home goods pricing insights.

Thank you for Subscribing - Team DataWeave

Book a Demo

Login

For accounts configured with Google ID, use Google login on top. For accounts using SSO Services, use the button marked "Single Sign-on".